VCs should play bridge

A lot of VCs play poker, and I get why. But as a metaphor for venture capital, or as a skill-honing extracurricular activity if you want to call it that, I think you can do better.

Poker is a game where you’re given an incomplete set of information and you have to fill in gaps based on what you see, what you don’t, and what you think other people are thinking. Poker is a game of interpreting signals, and so is VC. But the thinking and betting and bluffing in poker is all adversarial. It’s not a game of mutual shared interest.

Investing in startups isn’t like that. Individual deals are competitive, but at an ecosystem level, it’s positive-sum. As a VC, you are trying to pull off a challenging feat of economic coordination. The signals you’re sending among one another aren’t so much bluffing for individual gain as much as genuine signalling for mutual benefit. If you can pull it off, your whole squad wins. If you can’t, you get zero.

There’s a better card game metaphor for venture capital: bridge.

Startup funding is a coordination problem

Today’s VC ecosystem is such a well-oiled machine that we sometimes forget what problem it fundamentally solves. One recurring theme we talk about in this newsletter a lot is the idea that startups aren’t economically sensible. This isn’t a criticism of your startup; it’s just the reality of building the future without a road map.

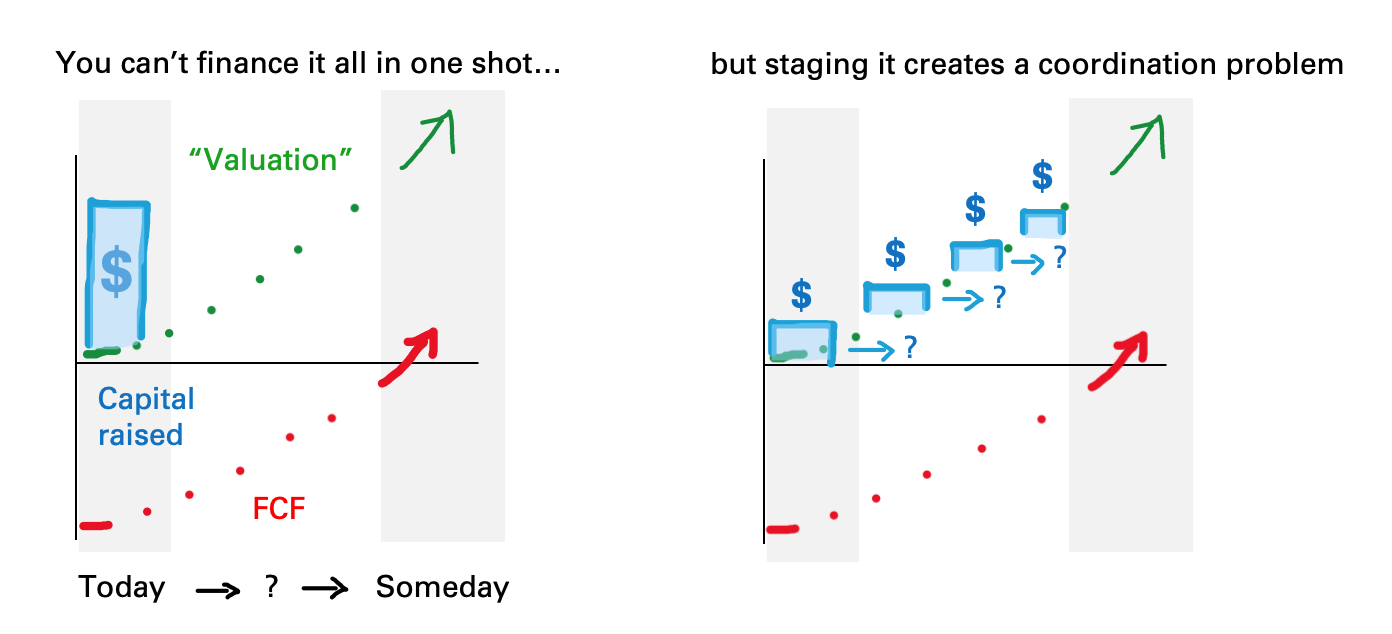

What do I mean by “not economically sensible?” When you set out to build an important piece of the unknown future, you have two missing pieces of information. First, you do not know how much money you will make if you succeed. You can guess – a lot, hopefully – but you cannot know. Second, you do not know how much capital you will have to raise before you reach positive cash flow. You can guess, but even the best-laid plans go awry when you enter unknown territory.

The combination of these two unknowns means that even the best founders cannot know the true value of their own equity – even if you could somehow correctly discount for execution risk. This is a problem! When you’re starting out, your equity is the main thing you have to trade. If you can’t know what it’s worth, and investors can’t either, you can’t fund yourself across the gap and get to positive cash flow.

What if you staged the investment? Raise capital in smaller buckets, rerating the risk and potential each time, like how we do it in VC. This solves one problem: by raising equity in smaller chunks, you ensure that no one check is large enough to overcapitalize and crush you, and it’s a lot easier for your investors to stomach, too.

But now you have a new problem. Staging investments isn’t a magical cure; it just changes the problem from one form to another: now you have a coordination problem between the present and the future. When you write the first check, do you know that the next check will not only be there, but will be willing to pay a higher price? And will that second check have that same confidence in the third check? And the fourth?

The early investors and late investors are in a bit of a standoff here. The early investor asks, why should I commit to writing the check, since I have the farthest amount of distance, dilution, and coordination risk between my check and a default-alive business? And the late investor asks, why should I commit to writing the check, when I have the least amount of information here? Meanwhile, no one really knows yet if this startup will pay off. Everyone’s looking around, wondering: am I the genius, or am I the idiot? Who knows something I don’t know?

We need a way to signal mutual interest: we’ll help you write your check, if you help us write our check. If we can both coordinate, we’re both better off.

VC Fundraising is an exercise in bidding conventions

Any good bridge player can tell you how to fix this coordination problem.

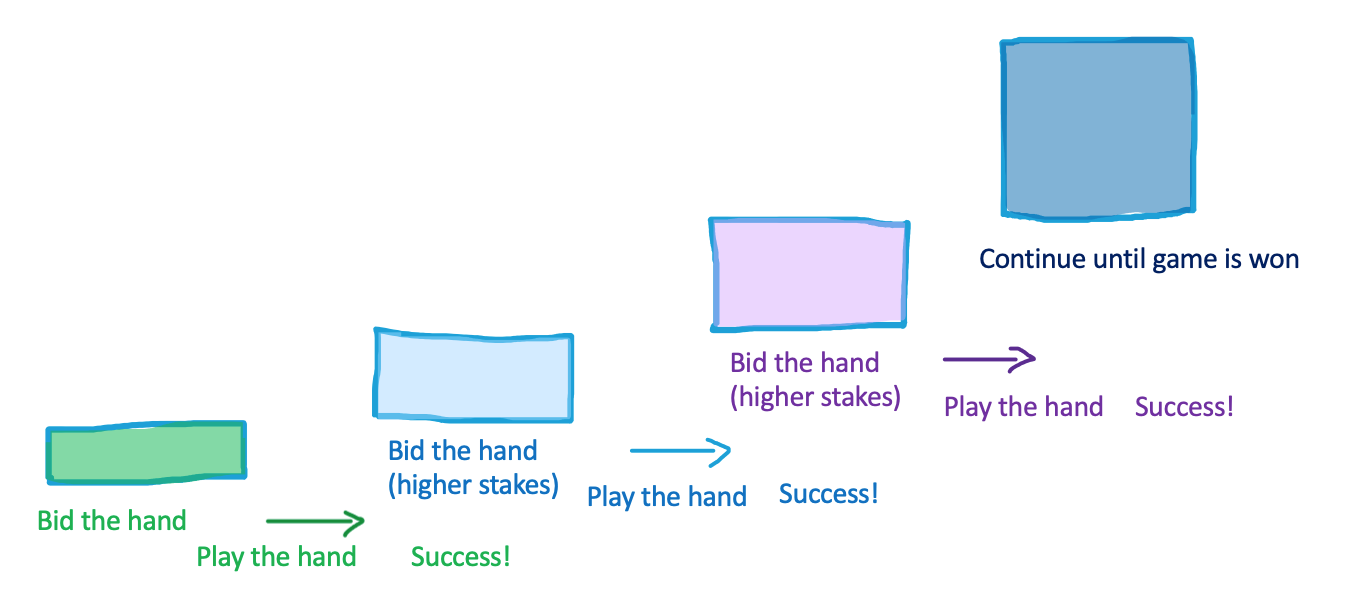

If you’re not familiar with the rules of bridge, the game works like this. Bridge is played in teams of two: you play with a partner, often someone you know well and play with regularly. There are two “phases” to a hand of bridge: the first phase is an auction phase, where the four players will bid on who believes that they (and their partner) can establish the most ambitious plan to win the hand. In the second phase, you play out the hand of cards and see if you lived up to the expectations you placed on yourself.

When you’re bidding, you and your partner have to figure out where there is alignment between your two hands. But you’re not allowed to talk: you can only communicate through your bids. Your bids have to serve two purposes: they are both literal commitments (if your bid wins, you must follow through with it) and also coded signals, which you use to try and telegraph information to your partner about where you see opportunity.

To be good at bridge, you have to master the dual nature of your bids: they’re both commitments and signals. Bidding is how you coordinate with your partner, iterate towards an agreement, commit to a hand, and then build on top of that hand to go win the next one. Sophisticated bridge players have built muscle memory for what every signal means, and what are the commonly understood conventions for how to interpret them in context.

This should sound familiar to anyone who works in tech! It’s similar to the interaction between founders and VCs as they iteratively raise money, round by round. When a VC issues a term sheet, they’re doing two things. First, it’s a literal commitment: if that term sheet is accepted, they have to put up money, and then help the founder realize that valuation over the coming 12-18 months.

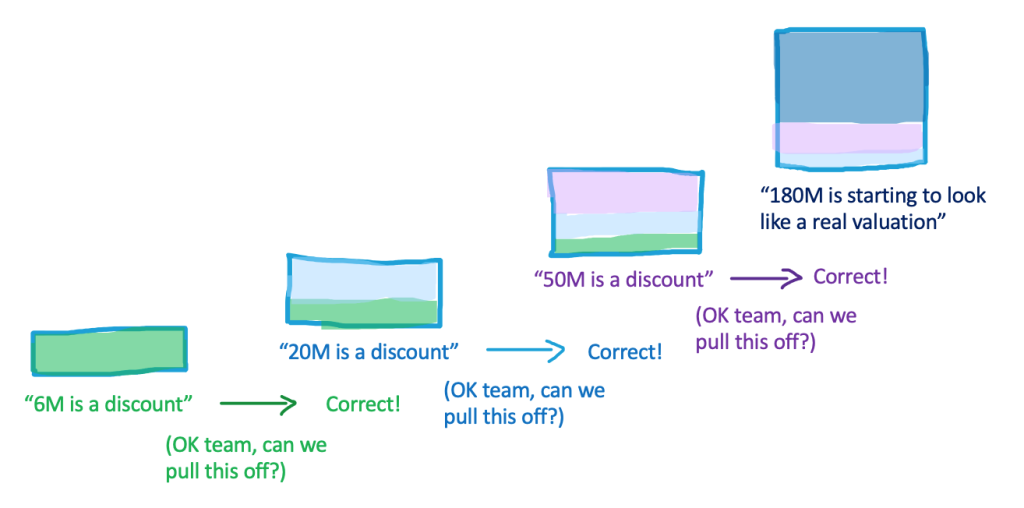

Second, it’s also a signal. The number on a term sheet, if we’re being honest, isn’t actually a “valuation” of the company. You can’t signal anything like “we believe this number represents a discount to book value” because book value is still imaginary at this point. But if you think like a bridge player, you’ll see an opportunity here. You can still communicate a lot of information with your bid; just different information, that’s more useful to the task at hand.

So you issue a term sheet, let’s say for 6 million pre money for someone’s first check. The choice of 6 won’t be random: it will reflect what their peer group is raising at, and what is understood by current convention as a specific set of promises. Market price changes continuously, but at any given moment you’ll have rules of thumb like, “500k in ARR gets you X valuation”, “Having two repeat cofounders gets you Y”, or “going through YC gets you Z.”

These are not real valuations: they’re more useful than that! In bridge terms, you’d call this convention bidding. It’s a real bid, and you commit to pay a real price. But your signal communicates something different, that’s understood by convention among the other players- “By signing this term sheet, we anticipate this company will grow into a 1.5M ARR business by next term sheet” or the like. It’s not a valuation; it’s a convention.

Bidding conventions don’t just take place within rounds; they also transmit important information across rounds. With their term sheet bid, early investors telegraph to both present and future investors: we believe that this $6M price reflects a discount to the price next round. Nowhere are they signalling, “this company is ‘worth’ 6 million dollars”; because the equity is still impossible to value. The signal is: “Now is your chance to get in at 6, because the next round will be higher.”

Then they “play the hand”, in bridge terms, and recalibrate based on how well the business was able to grow into the valuation. When next round comes along, at let’s say $20M, the early investor gets to adjust or re-up their signal by defending or augmenting their pro rata.

This gives the next investor cover to say, ok, I’ll do the same thing. I’ll invest at $20M, sending a signal: I believe that this price reflects a discount to the next round. This 20 million price, by current convention, means we believe this hand will play out as another X million in GMV run rate”, or whatever it is your signalling for this new round of bidding.

If you carry this forward across multiple rounds of funding, this remarkable emergent coordination takes place: the early investors signal forward to the later investors, “you’re covered”, and then implicitly, the late investors signal back to the early investors, “you’re covered too” – even though those rounds haven’t actually happened yet. It’s highly recursive, like the blue eyes problem you learn in undergrad CS.

This is how Silicon Valley has created a kind of “controlled bubble” sort of environment, where inflated valuations can defy gravity for a lot longer than they normally should. The intricate system of back-and-forth signalling between present and future investors, and even the ability to place bids at permissible valuations at all, is only possible because VCs have learned convention bidding.

If VCs were stuck in the dark ages of having to bid only their literal assessments of formal valuations, they’d be like beginner bridge players who only know how to do straight bidding. Learning conventions is powerful, because it buys you more time, runway and oxygen.

There are risks, of course. One common kind of signalling risk that entrepreneurs learned about the hard way over the last ten years was to be careful raising seed funding from larger VC firms. As VC firms raise larger funds during the 2010s, many of them launched seed programs that could write small checks quickly, and build up a roster of early-stage investments in order to see a lot of Series A deals down the line.

There’s obvious signalling risk here: for the 90+% of companies that received seed checks but no A term sheets, that’s not a good look! That signalling risk created an obvious opportunity for angel investors, scouts and seed funds who filled the funding gap. Instead of VC firms funding seed deals directly, and therefore revealing signals obviously, now investors looking for clues must navigate a subtler field of signals: did the company raise from a seed fund whose LPs are GPs at a fund who actively passed?

An evolution in VC means new bidding conventions

If we look forward to the next several years, you want to know where there’ll be some really interesting signal conventions to figure out? When startups start using debt more often. In the founder-VC dynamic thus far, one assumption that’s been more or less taken for granted is that if founders want cash, raising equity is how you do it. But now, founders (especially ones with recurring revenue type businesses) are learning they have other options. This’ll change cap tables, and it’ll change signalling conventions too.

It doesn’t even have to be a classic debt round. Pipe launched this past week with a new service that lets founders raise cash against their accounts receivable, which for a recurring revenue SaaS company can be a pretty attractive alternative to selling your equity. Clearbanc, another company I know well, offers a similar option for founders with predictable sales who need cash up front to fund their business.

So think about if a company who’s an active customer of Pipe or Clearbanc goes to raise an equity round later: is that a negative signal for the new investor, because there’s effectively someone more “senior” than them at the table? (There may not be actual debt in the company’s cap table, but they’ve sold off tranches of their revenue – six of one, half a dozen of the other.) Or is it a positive signal, because they may need less equity later, and that means less dilution for you? Is it a negative signal, because debt is restrictive? Or is it a positive signal, because it means the business has reached a degree of repeatability, and can lower their average cost of capital?

This is all exciting, but it’s going to be a challenging time as everyone’s muscle memory around signalling gets thrown out the window. We may have to relearn a lot of what we take for granted, as we suddenly have to contend with new kinds of strong and weak signalling that we didn’t used to have to consider before.

More generally, as debt arrives to the startup world (on whatever schedule it may), we’ll perhaps see tech converge with the rest of the world, where selling equity is viewed as a weaker signal whereas selling debt is viewed as a stronger one. If you’re a company who raises money by selling equity, you’re basically telling the market: “Hey, we have the most information here, and we think our stock is overvalued. We’d rather have the cash.” This is true everywhere else but in Silicon Valley.

Why not here, though? Well, for one, founders typically don’t have any other option. But the other reason why is because investors on the other side of that deal are signalling, “I believe I’m getting a good deal buying this equity. And unlike the founder, who has one company, out of the last 100 deals I’ve seen, I pick this one. This price represents a discount to the next round, which there definitely will be.” The investor sends a stronger signal than the founder does, so we weight them accordingly.

But now founders have a new option, and they’ll be able to get in on the signalling game too. And I’ll leave you with a pitch for why founders and VCs should think about learning bridge: it turns out there’s a perfect exercise for thinking in terms of debt versus equity and how to signal around both of them, that happens in bridge all the time. It’s in learning the difference between playing a suit contract versus a no trump contract.

Most of the time, when you play a hand of bridge, you’re in a “suit contract”: one suit is trump. In hands like this, when you assess the strength of your hand and plan your signals for your partner appropriately, you take an approach called “counting your losers”, which translates roughly to, “here’s how much slack you have to work with.” But in another kind of contract, called a No Trump contract, you assess your hand strength differently: you count winners, not losers. This translates differently; to something more like “here’s what I’m not allowed to mess up.” (Does this ring any bells? It should!)

Anyway, if you want to up your game as a signalling master, and get ahead of big changes that are about to happen to the way VC growth deals get done, go learn how to play bridge. You can start with Euchre if you want, which is a simplified version, but I recommend getting to the real thing if you can. You’ll build signalling muscles you never knew you had, and it’s pretty fun, too.

Like this post? Get it in your inbox every week with Two Truths and a Take, my weekly newsletter enjoyed by thousands.

Recent Comments