Debt is Coming

Ten years from now, what seismic change will we reflect back on and think, “well that was pretty obvious, in retrospect”?

Debt is going to finally come to the tech industry.

We can hate it, we can criticize it, we can raise the alarm about how dangerous debt is to the VC model we’ve honed to perfection over decades. Or we can see this moment for what it is: a turning point into a new deployment period for software and the internet. Debt is coming, whether we like it or not. And I’m actually pretty excited for it.

The Deployment Period

When people in tech want to sound smart, one name you can drop is Carlota Perez. Her book Technological Revolutions and Financial Capital is a rare accomplishment: it’s a top-down “grand theory” book about the innovation economy, written by an academic rather than an on-the-ground practitioner, that actually gets things right. Read it alongside Bill Janeway’s Doing Capitalism in the Innovation Economy, the number one book that’s most influenced my own thinking.

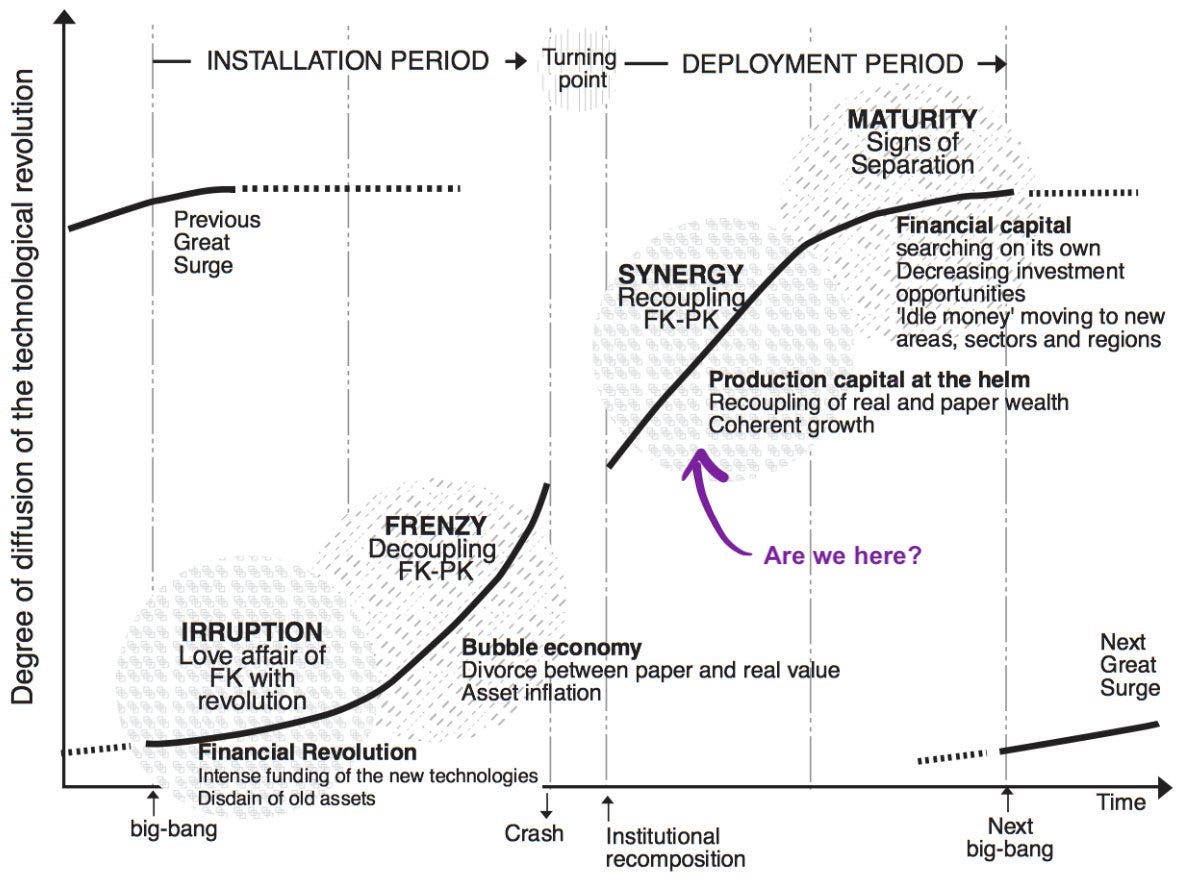

Technological Revolutions & Financial Capital explores the relationship between Financial Capital (the equity and debt that’s owned by investors) and Production Capital (the factories, equipment, processes, and other real-world concerns which financial capital owns). Perez’s core message in the book is that Financial Capital (FK) and Production Capital (PK) have changing but predictable relationships with each other in distinct phases of technological development and deployment.

There’s a recurring dynamic of how FK and PK perceive each other and work with one another. Jerry Neumann’s explanation is good: “My long-ago operations research textbook had a cartoon showing one MBA talking to another: ‘Things? I didn’t come here to learn how to make things, I came here to learn how to make money.’ This is the view of financial capital. The view of production capital is exemplified by Peter Drucker: ‘Securities analysts believe that companies make money. Companies make shoes.’”

In the first phase of a technological revolution, which she calls the “Installation Period”, the relationship between FK and PK is fundamentally a speculative one. The new technology is exciting, and the market opportunities are large but unknown. Speculative investment, with ambitious but inexact expectations of financial return, is important fuel for founders who build the unknown future. However, investors and operators are often deeply misaligned: investors think in bets, while operators think in consequences. The relationship is tense, but can be explosively productive. The VC model is an institutional expression of this tension.

In the Deployment Period which follows, FK and PK recouple. We reach a turning point away from speculative financing and towards more aligned investment, where capital gets put to work less exuberantly and more deliberately. The investor, at this point, has a good understanding of the assets that they’re buying and the cash flows that they will generate. The operator has reasonable expectations around cost of capital, and a tried-and-true game plan for how to put that capital to work making shoes. This does not look like VC. It looks like regular finance.

Meanwhile, the Deployment Period is usually when the peace dividend of emerging technology starts to really pay off. Tech is mature and ubiquitous enough that it starts to get deployed everywhere, in a way that’s especially helpful for smaller customers who are now finally have access to the same tools and the same firepower as their bigger rivals. We enter an era of abundance, where technology creates far more value for its customers than for its vendors. FK transitions away from speculative risk capital and towards boring, deliberate underwriting.

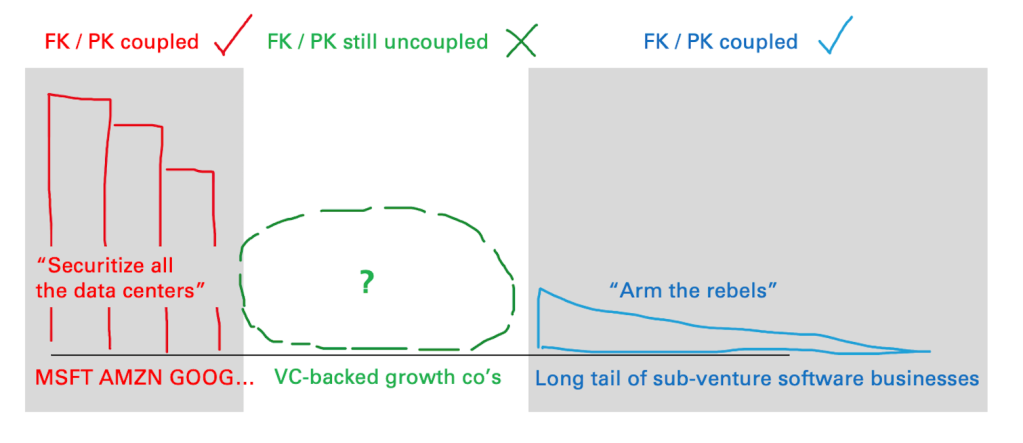

Are we there yet? Well, yes and no. “Tech” is not a monolith industry. Silicon Valley angels and VCs still live out in the speculative future, funding wild bets with out-of-the-money call options. At the same time, big tech incumbents can put capital to work at scale, with little guessing involved. Furthermore, we’ve entered the “let a thousand flowers bloom” era of online companies. A new generation of small businesses has learned to take full advantage of software and the internet, understands their customers, and knows how to put capital to work serving them.

There are three tech industries today, and two of them are solidly in the deployment period. If you want to put $100 million to work, you could lend it to Andy Jassy or Sundar or Satya and say “Go build a data centre with this”. (Or, even better, securitize it.) Startups used to build or buy their technology stacks; now they rent them. The “peace dividend of the cloud wars”, currently between AWS, Azure and GCP, means that startups can increasingly choose to move most of their technology off their balance sheet forever: the AWS bill as the new electric bill. That’s production capital.

Or you can lend it to Shopify or Clearbanc or Stripe Capital and say, “Go arm the rebels with this.” If your business is making shoes and then selling them online, then you can go get funding that’s committed to help you make shoes and then sell them online. Small merchants are getting access to the same tools, and eventually the same capital, as big giants. There’s no speculation involved: the lender, the platform and the merchant all know pretty much exactly where the money’s going, and what’s expected of them. That’s production capital.

Of course, you could also take that $100 million and commit it to a VC fund. Then it’s back to the Wild West of speculative equity financing, out-of-the-money bets, and “we can’t know until we try.”

Or is it?

Recurring Revenue

The recurring revenue business model, which everyone in tech knows well by now, may feel mature. But I promise you: we’re only in the early days of its second-order consequences.

The model got off the ground after the dot com crash, from logical origins. The “pay as you go” model for subscription software is great for customers, who no longer need to shell out an up-front payment like they had to in the days of packaged software licenses. The software purchase already comes pre-financed, baked into the SaaS model. The downside to this model is that it takes longer for startups to reach positive cash flow. As Bill Janeway explains:

While the SaaS model made it radically easier to sell software and to forecast reported revenues as contractual payments were made over time, it came with a cost. Salesforce.com was the first enterprise software company characterized by sound operating execution to consume more than $100 million of funding to reach positive cash flow. Now the poor start-up was in the role of financing the rich customer. Funding from launch to positive cash flow for a SaaS enterprise software company runs from that $100 million to twice as much or more, some five times the $20–30 million of risk equity once required to get a perpetual license enterprise software company to positive cash flow.

VCs have happily stepped in with the cash. The SaaS model was a great way to deploy capital: these new businesses spend an (often large) initial expense to create a user, and then harvest a (fairly predictable) stream of income from that customer you’ve created. Any one customer may be unknowable, but cohorts of customers can be modelled and understood decently well. VCs have successfully expanded this template to adjacent business models like marketplaces, recurring shared value transactions, and all sorts of consumer businesses.

As this new model came together, the word “user” became the most important word in tech. People on the outside sometimes wonder why businesses with so few traditional assets seem to require so much financing. Well, they are accumulating assets: users are the new assets, and their use is what you’re out to monetize.Whatever your business model is, acquiring users is the new building factories.

The overall bet may still be speculative, but the median VC dollar isn’t anymore. It’s buying customer acquisition and then financing service delivery. In plain sight, ever since the dot com crash, VCs have learned and applied the same lesson as GM and Ford years ago: the best way to make money isn’t making cars, it’s in financing them.

This looks as though it could be deployment money to me! But it isn’t yet: so long as this recurring revenue is financed with VC equity, there’s still this tension between VC’s portfolio approach (FK) versus founders’ and employees’ complete commitment (PK). Still, though, the fact that it could be aligned – given the relative stability and maturity of the recurring revenue software model – suggests that we’re overdue for some new financing strategies.

Maybe not all investors get this, but the smart ones do. Jonathan Hsu of Tribe Capital and I used to talk about this a lot back when we were at Social Capital, and when I interviewed him last year in the newsletter he put it this way:

When you acquire some customers and they start yielding revenue that behavior sounds an awful lot like buying a fixed income instrument and there is a lot of sophistication around how to value those cash flows. In some sense, what we’ve seen over the last decade is that software enables a whole new business model – recurring revenue – which is both good for customers and is good for investors. It’s good for investors because it becomes more “predictable” in the sense that it starts to look more like a fixed income yielding asset and thus more amenable to traditional financial techniques and thus potentially “in scope” for a wider set of investors. (Emphasis mine.)

One big lesson in Technological Revolutions and Financial Capital is that the innovation financing game is played with different rules when FK and PK are aligned versus when they aren’t. In the ramp up of the installation phase, culminating with the frenzy of a bubble, you’re playing one game – where FK and PK have to navigate a lot of ambiguity, and tolerate a high failure rate. Today’s VC model, where businesses are built with all-equity capital stacks and portfolio construction anticipates a power law return curve, is hyper-optimized to play this game.

If you’re a tech founder raising capital today, there’s really one mainstream way to fund it: by selling equity. The VC model capital stack, which the Silicon Valley venture ecosystem has optimized itself around, is the one-size-fits-all funding model for startups of all shapes and sizes. We know it like muscle memory at this point. If your career began after the dot com crash, as mine and I’m sure many of yours did, you’ve probably never known any other way.

But the deployment period is a different game. And when FK and PK get really aligned with each other, the best tool in the game isn’t equity anymore.

The problem with equity

Here is a widely believed cause-and-effect relationship I bet you’ve never thought to invert before: because most startups fail, therefore equity is the best way to finance them. Have you ever considered: because equity is how we finance startups, therefore most startups fail?

This feels uncomfortable! But it gets right to the core of the FK-PK misalignment that saturates the modern tech industry, and holds us back from entering the deployment game, with its new set of rules. In the early stages of a startup, the conventional cause-and-effect direction is correct: we use equity, because there’s uncertainty. But later on, I’m not so sure.

Plenty of people these days preach “startups need to rely less on fundraising”; it’s harder to find anyone who’ll challenge the equity mechanics themselves. But continuously selling equity, even at high valuations, is more expensive than the narrative suggests. As a founder, the most valuable optionality you have is the equity you haven’t sold, and the dilution you haven’t taken. But the second most valuable optionality you can have is a valuation that’s not too high.

I don’t just mean that high valuations destroy discipline and focus, although that’s also true. I mean strictly in terms of optionality you’re giving up. The higher your equity valuation, the fewer out of all possible future trajectories for your business are acceptable. After the past few years, I think most founders get this. If you must go raise a ton of capital, then boosting your valuation isn’t preserving your optionality; it’s trading one kind for another.

The wakeup call will be when founders collectively come to grips with the fact that the Financial Capital all-equity stack, as powerful as it is for creating something out of nothing, is and has always been at odds with the Production Capital mentality of a business builder and operator. There is nothing inherent to tech companies that requires that so many of them fail to live up to their aspirational valuations, aside from the way they’re funded.

But can’t debt blow up in your face? I mean, yes, but so can preferred stock! But debt is up front about it, whereas liquidity preferences aren’t a problem until one day they are. Investors genuinely mean well almost all of the time, but the alignment between the Financial Capital of VC and the Production Capital of software businesses really only works for one narrow version of success. I’ll bet you founders will increasingly ask for paths to many different versions of success, not just one.

Of course, there is a way to have your cake and eat it too: raise more capital, with less dilution on your cap table, and without needing a dangerously pumped valuation. It’s to raise some debt! Not a huge amount; I’m not arguing founders will be better off if they start racking up enormous debt loads instead of raising VC rounds. Debt is not runway. I’m just saying, there’s more than one way to construct a capital stack. And that, believe it or not, taking on some debt can be a smart way to finance a business. Everyone else in the business world understands this!

Where could you put debt to work effectively? Oh, I dunno, how about that thing that every tech company does now: creating customers! You have to spend a bunch of money today to acquire users. But once you have them, they send back recurring revenue that’s pretty predictable at a cohort level. Hmm! Tech companies with recurring revenue business models are this close to connecting the dots.

Gradually, and then Suddenly

There are still some big reasons why most Silicon Valley tech companies don’t use debt all that much. One obvious reason is that lenders aren’t used to extending credit to fast-growing software companies. It’s not like this is an unsolvable problem, since recurring revenue is pretty attractive to borrow against. But the big banks and usual lenders haven’t really worked it out yet.

The other reason is more of an internal issue. If you raise debt, unless it’s for some specific purpose (like if you’re a fintech company), it’s usually seen as a big red flag that’s prohibitive to future equity raises.

In an environment that’s fine tuned for “you’re growing or you’re dead” and where signalling is everything, debt on your cap table means something has gone wrong. To people in other industries, this looks strange: if you’re a growth business, debt is how you grow faster! But not here: we’ve got our formula, and if you stray from it, it throws off the process. Debt can also scare off growth equity funds, who don’t like not being the most senior money in the pref stack.

In both cases, debt in your cap table imposes a financing risk. So unless you have line of sight to positive cash flow, debt won’t usually be your first choice. We do see venture debt get used in scenarios like bridge rounds and other special situations, but its customers are really the VCs, not the business. It’s not primary growth fuel. The benefits of debt aren’t worth the risk you’d take by potentially alienating yourself from future access to capital. “Don’t take debt” is tech’s “Four legs good, two legs bad.”

Furthermore, in the Bay Area Founder-VC scene, FK/PK tension simply isn’t perceived as a problem. Founders increasingly think of themselves as capital allocators who think in bets, and the angel investing scene has brought founders and VCs together as social peers. There’s no FK/PK tension between investors and founders. They all want the same thing, and they all hang out at the same parties. The tension has simply been redistributed, largely onto employees. The greatest trick VCs ever pulled was convincing founders, “you’re just like us.”

That’s why I’ll bet we first start seeing debt get used as real growth fuel in Silicon Valley-style software companies from companies that aren’t from Silicon Valley. I think this is a great opportunity for other startup ecosystems, especially ones with local capital bases (looking at you, New York? Tel Aviv?) to compete with the Bay Area for teams and talent by creating an alternative capital stack model for funding software companies. (“Come to New York; keep more of your equity!”)

By the way, I fully expect that a lot of people in VC will disagree with this. Of course they do! Just know: if you talk to people in VC about this, and then you talk to people at companies who are building the future of this stuff, you come away with two completely different impressions. I’m not sure I’d bet on the VCs.

The tipping point happens when someone big, and probably local, announces a new financing product: recurring revenue securitization.

I honestly think this makes so much sense. Why not go straight to securitizing senior tranches of your recurring revenue, and moving it off your balance sheet? You could imagine a high-quality startup financing its growth this way: raise your initial equity to establish your product, go-to-market, and first big cohort of users. Once you understand that first cohort of users really well, securitize the first X% of the cash flows they generate, get em off your balance sheet, and then use that money to create your next cohort of users. Keep raising equity to grow the other parts of your business, by all means, but just raise less of it!

There are all sorts of ways you can get creative with this. Let’s say your business has solid product-market fit in its “base layer” of recurring revenue, and your main focus is on whether or not you can successfully build expansion revenue on top. As you raise capital, maybe consider that these two tasks could be financed differently? If a startup is making lots of different bets as it grows, maybe those bets might have different return profiles, and could be funded accordingly?

On the other side, imagine how much investor interest you could get in a diverse basket of recurring revenue from, say, 10 different startups that’ve all raised from Tier 1 VCs. People talk about how great it would be to invest in a unicorn basket; this would probably be even better. In some ways this is threatening to VCs, since it’s competing capital; but it also reinforces their importance as curators and underwriters.

The risk to VCs isn’t that their role disappears. It’s that once this happens, the muscle memory for how to structure funds and term sheets immediately goes out of date. VC firms should spend time today thinking about how they’re going to prepare for this new world, in case it comes true.

If you think there’s too much money flowing into startups now, just wait until someone makes a high-yield fixed income product for institutional investors to buy recurring revenue. In my 10 predictions for the 2020s post, one of my predictions was a that we’re going to replay the Softbank capital-as-a-moat funding calamity, but with enterprise software this time. Recurring revenue securitization will be like gas on the fire. Forget Softbank; imagine what it’s going to be like competing against someone who’s hooked up to the debt market.

VCs need to be ready for this new game. Many of them are already preempting it, deliberately or not, as they transition into these multi-stage battleship firms with scout programs, venture teams, and growth funds. I’m not sure it makes sense for these firms to raise their own debt funds though. More likely, we’ll see a few top-flight firms announce partnerships with Stripe Capital and Goldman Sachs, and just roll it right in with their Series B term sheets.

Expect, at this point, some pretty funny “Actually, four legs good, two legs better” blog posts from some of the same VCs who told us to never take debt a few years before. “Ah, see, that debt was reckless gambling; this debt is being equity efficient”. K thanks.

And when founders really get a taste of that credit? That sweet, sweet taste of dilution-free capital, flowing freely to and from a continuous growth vehicle, and learn the dark arts of securitization? And then when their competitors learn about it? It is game over for the old way.

Proceed carefully, but get excited too. This is a good thing. A realignment between financial and production capital is long overdue, and it’s going to hit like an earthquake. But it’s going to level up our collective ability to put capital to work into new and interesting businesses. We could be around the corner from a technological golden age, where software and the internet can get massively deployed in a production-forward way. The world wants this so badly. And we’re almost there.

Like this post? Get it in your inbox every week with Two Truths and a Take, my weekly newsletter enjoyed by thousands.

Recent Comments